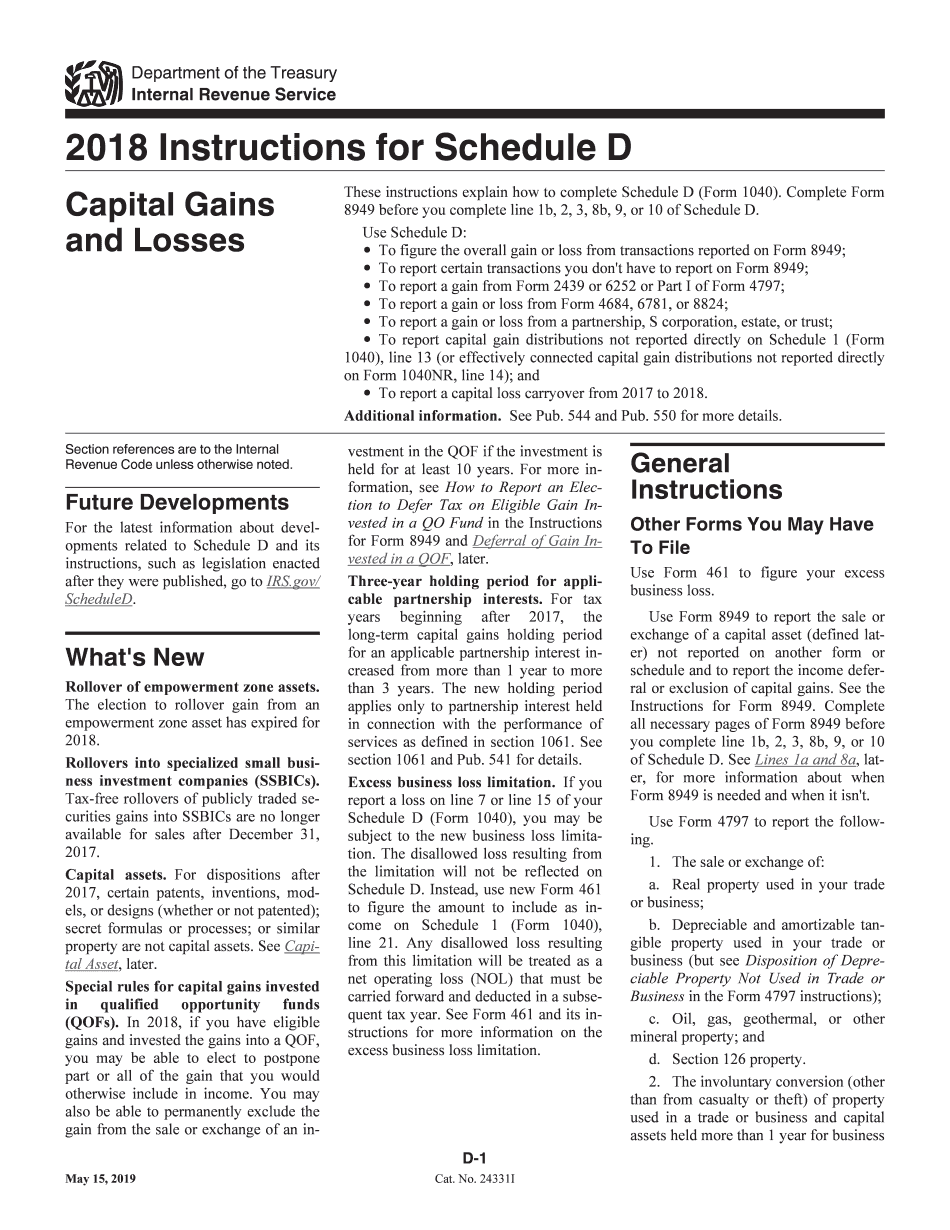

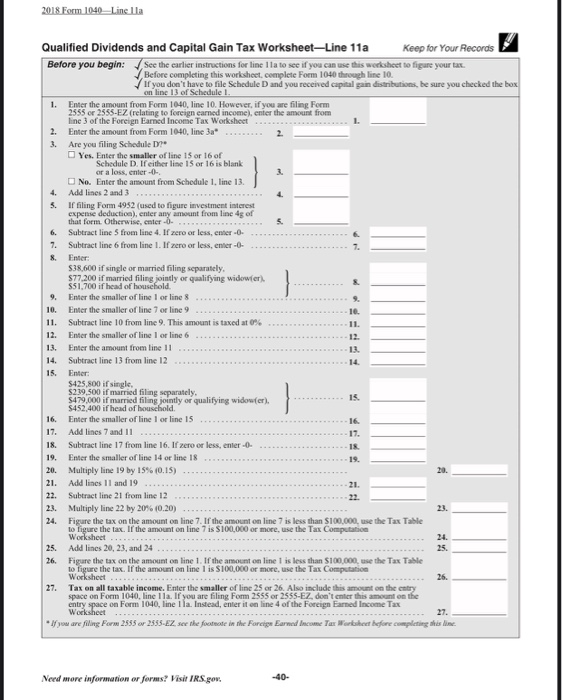

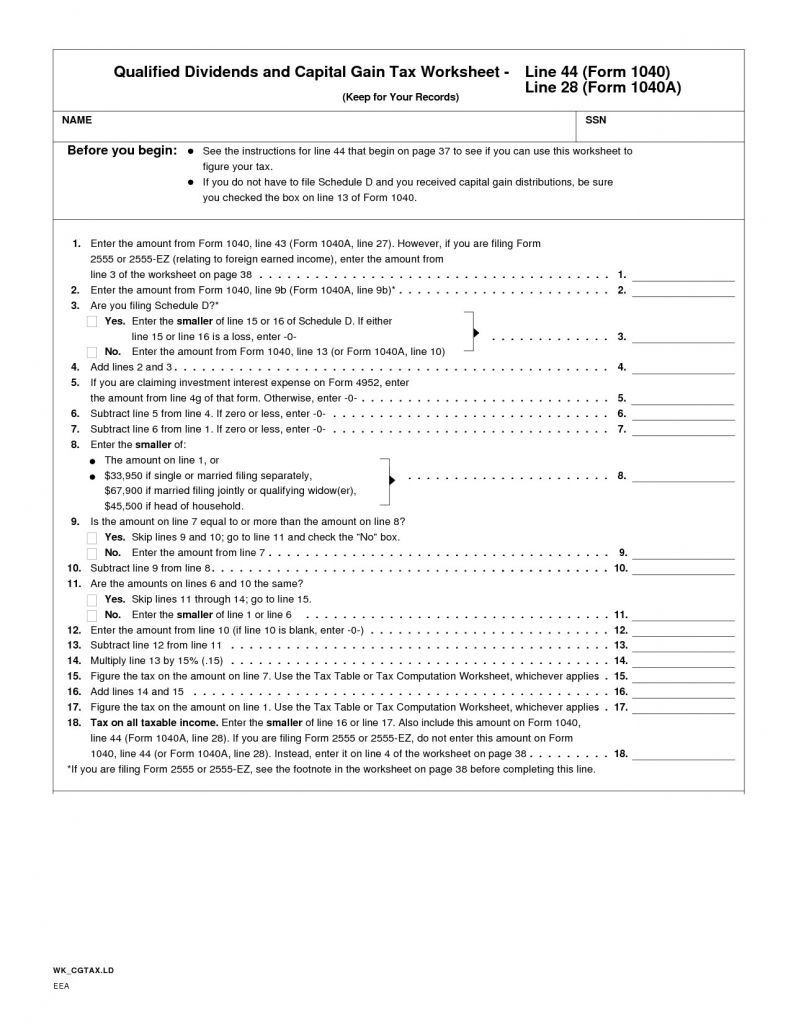

Fillable Qualified Dividends And Capital Gain Tax Worksheet - Web you’ll need the qualified dividend and capital gain worksheet for the following major purposes: Get a fillable qualified dividends and capital gains worksheet. Web qualified dividends and capital gain tax worksheet 2022. Basically, the 5% ratio is the amount from the. The worksheet is part of form 1040 which is mandatory for every. Web how to calculate the total adjustment amount on form 1116. Web edit qualified dividends and capital gain tax worksheet 2019. Web 2018 form 1040—line 11a qualified dividends and capital gain tax worksheet—line 11a keep. Go to www.irs.gov/scheduled for instructions. Web use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the.

qualified dividends and capital gain tax worksheet 2019 Fill Online

Complete form 8949 before you complete. Web the qualified dividends and capital gain tax worksheet in the instructions for form 1040, line 44 (or in the instructions for form. Web qualified dividends are taxed at the same rates as the capital gains tax rate; Web introduction these instructions explain how to complete schedule d (form 1040). Web qualified dividends and.

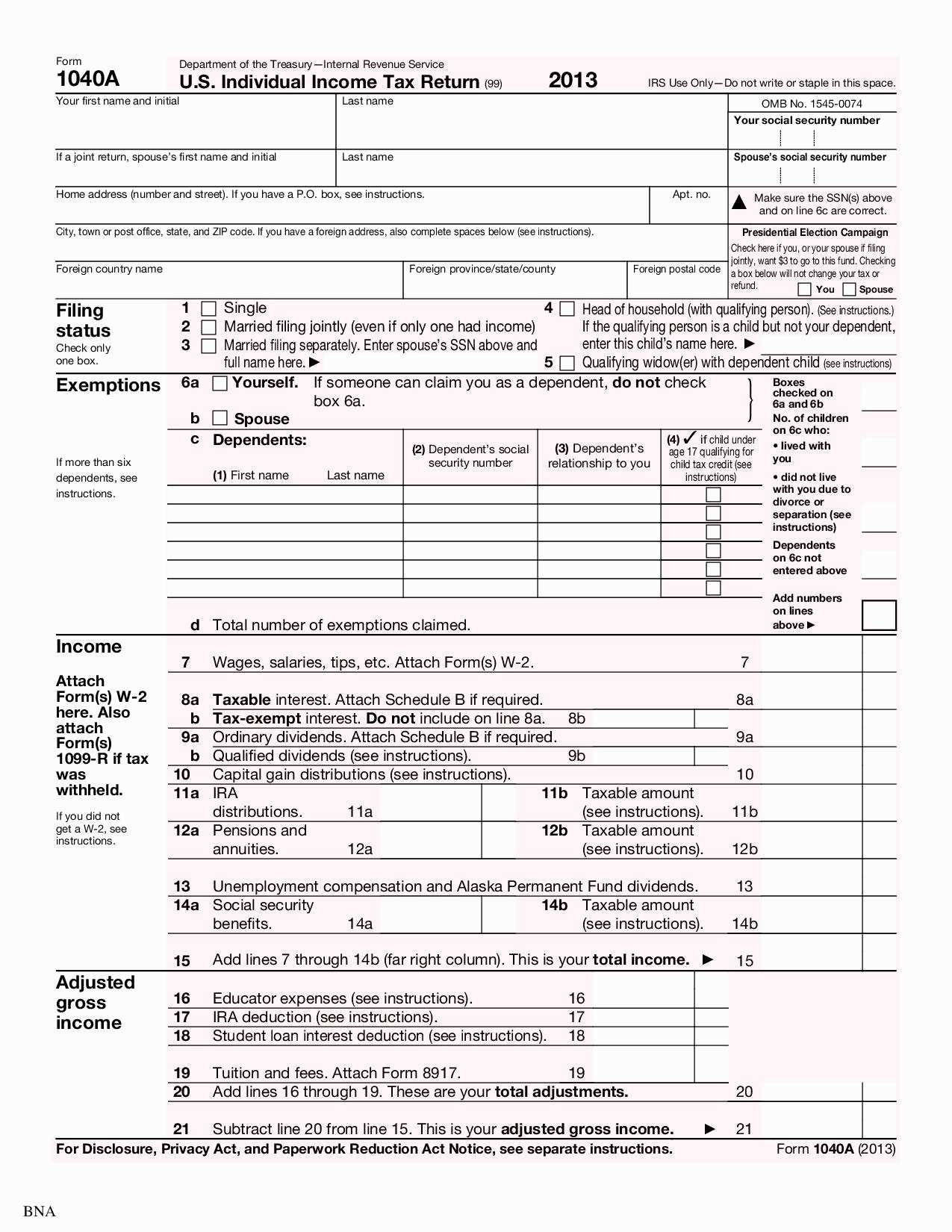

1040a Capital Gains Worksheet

Web edit qualified dividends and capital gain tax worksheet 2019. Web 2018 form 1040—line 11a qualified dividends and capital gain tax worksheet—line 11a keep. Web a qualified dividend is taxed at the capital gains tax rate, while ordinary dividends are taxed at standard federal income tax rates. Web qualified dividends and capital gain tax worksheet: Web qualified dividends and capital.

Review Alexander Smith's information and the W2,

Web qualified dividends and capital gain tax worksheet. Web edit qualified dividends and capital gain tax worksheet 2019. To inform the irs of your dividends from shares or ltcg; These rates are lower than ordinary income tax. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax.

Qualified Dividends And Capital Gain Tax Worksheet 2019 worksheet today

Web the qualified dividends and capital gain tax worksheet in the instructions for form 1040, line 44 (or in the instructions for form. Web qualified dividends and capital gain tax worksheet 2022. Web qualified dividends are taxed at the same rates as the capital gains tax rate; Web fill online, printable, fillable, blank 2020 qualified dividends and capital gain tax.

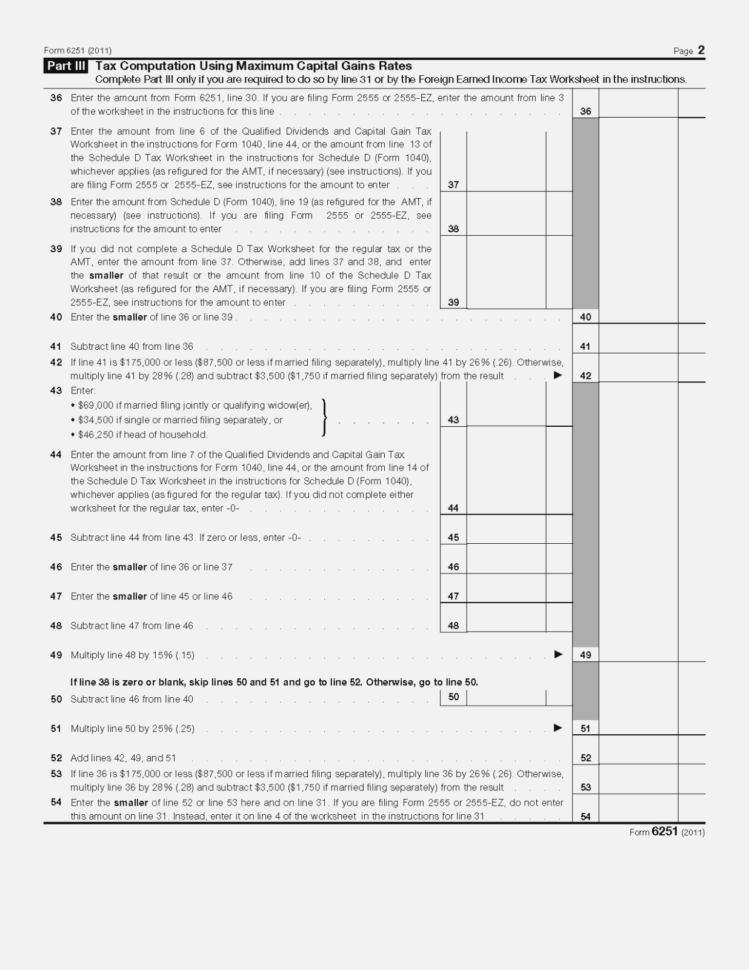

Amt Qualified Dividends And Capital Gains Worksheet Ivuyteq

Web 2018 form 1040—line 11a qualified dividends and capital gain tax worksheet—line 11a keep. Web a qualified dividend is taxed at the capital gains tax rate, while ordinary dividends are taxed at standard federal income tax rates. Easily add and highlight text, insert pictures, checkmarks, and. Web qualified dividends and capital gain tax worksheet: Web please show how the results.

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Web qualified dividends and capital gain tax worksheet 2022. Web • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Web you’ll need the qualified dividend and capital gain worksheet for the following major purposes: Go to www.irs.gov/scheduled for instructions. Web use the qualified dividends and capital gain.

Qualified Dividends And Capital Gains Worksheet 2019 12a Worksheet

Web qualified dividends and capital gain tax worksheet 2022. Easily add and highlight text, insert pictures, checkmarks, and. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. The worksheet is part of form 1040 which is mandatory for every. Web a qualified dividend is taxed at the.

Qualified Dividends And Capital Gain Tax Worksheet 2017 —

Web the qualified dividends and capital gain tax worksheet in the instructions for form 1040, line 44 (or in the instructions for form. Web • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Web 2018 form 1040—line 11a qualified dividends and capital gain tax worksheet—line 11a keep..

Qualified Dividends And Capital Gain Tax Worksheet —

Web please show how the results from the qualified dividends and capital gain tax worksheet are applied to the 1040. Web fill online, printable, fillable, blank 2020 qualified dividends and capital gain tax worksheet (h&rblock) form. Web introduction these instructions explain how to complete schedule d (form 1040). Easily add and highlight text, insert pictures, checkmarks, and. Web the irs.

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Web use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the. Web you’ll need the qualified dividend and capital gain worksheet for the following major purposes: Web one item that all taxpayers must complete is the qualified dividends and capital gain tax worksheet. Web introduction these instructions explain how.

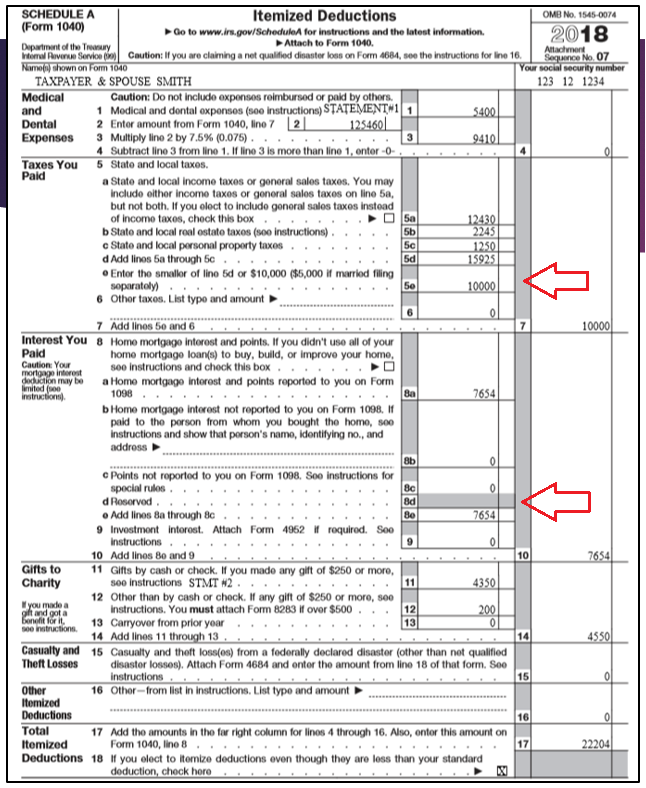

Web • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Web edit qualified dividends and capital gain tax worksheet 2019. Easily add and highlight text, insert pictures, checkmarks, and. Web you’ll need the qualified dividend and capital gain worksheet for the following major purposes: Basically, the 5% ratio is the amount from the. Web qualified dividends and capital gain tax worksheet: Web the irs recently released the new inflation adjusted 2023 tax brackets and rates. Complete form 8949 before you complete. These rates are lower than ordinary income tax. The worksheet is part of form 1040 which is mandatory for every. Web how to calculate the total adjustment amount on form 1116. Go to www.irs.gov/scheduled for instructions. Web fill online, printable, fillable, blank 2020 qualified dividends and capital gain tax worksheet (h&rblock) form. Web qualified dividends and capital gain tax worksheet. Web form 1040 qualified dividends and capital gain tax worksheet 2018 on average this form takes 7 minutes to. Web qualified dividends and capital gain tax worksheet 2022. Web please show how the results from the qualified dividends and capital gain tax worksheet are applied to the 1040. To inform the irs of your dividends from shares or ltcg; Get a fillable qualified dividends and capital gains worksheet. Web the qualified dividends and capital gain tax worksheet in the instructions for form 1040, line 44 (or in the instructions for form.

Web Use The Qualified Dividends And Capital Gain Tax Worksheet Or The Schedule D Tax Worksheet, Whichever Applies, To Figure Your Tax.

What is the tax rate for qualified. Web qualified dividends and capital gain tax worksheet. Web one item that all taxpayers must complete is the qualified dividends and capital gain tax worksheet. Get a fillable qualified dividends and capital gains worksheet.

Web The Qualified Dividends And Capital Gain Tax Worksheet In The Instructions For Form 1040, Line 44 (Or In The Instructions For Form.

Web the irs recently released the new inflation adjusted 2023 tax brackets and rates. Web form 1040 qualified dividends and capital gain tax worksheet 2018 on average this form takes 7 minutes to. Web edit qualified dividends and capital gain tax worksheet 2019. Web qualified dividends and capital gain tax worksheet:

Web Please Show How The Results From The Qualified Dividends And Capital Gain Tax Worksheet Are Applied To The 1040.

Web introduction these instructions explain how to complete schedule d (form 1040). These rates are lower than ordinary income tax. Web you’ll need the qualified dividend and capital gain worksheet for the following major purposes: Web qualified dividends and capital gain tax worksheet 2022.

Web A Qualified Dividend Is Taxed At The Capital Gains Tax Rate, While Ordinary Dividends Are Taxed At Standard Federal Income Tax Rates.

Basically, the 5% ratio is the amount from the. Complete form 8949 before you complete. Web fill online, printable, fillable, blank 2020 qualified dividends and capital gain tax worksheet (h&rblock) form. To inform the irs of your dividends from shares or ltcg;