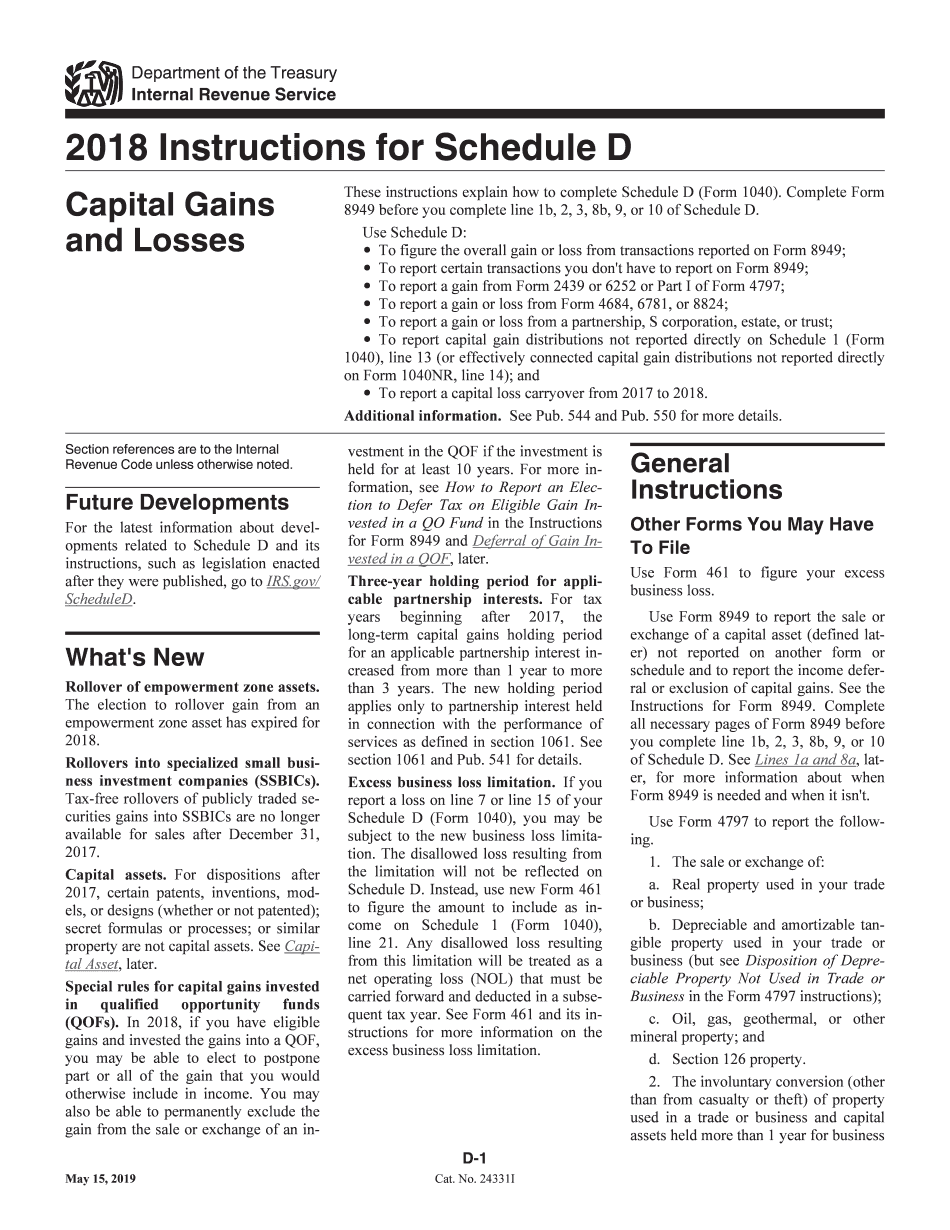

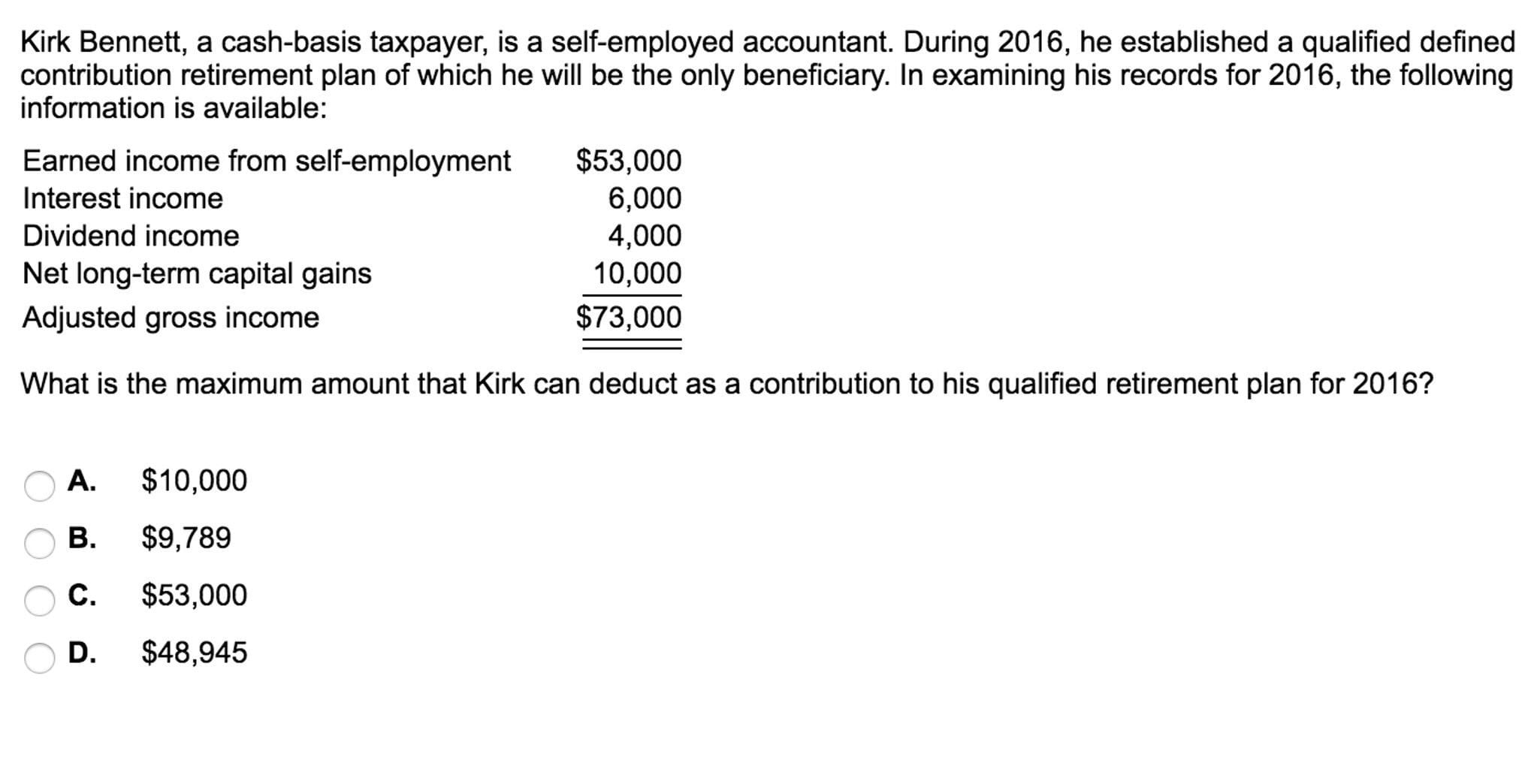

Capital Gains And Dividends Worksheet - Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the. Web how to download qualified dividends and capital gain tax worksheet? Alan wong, cpa gains& losses sec. Qualified dividends and capital gain tax worksheet. Simple capital gains worksheet let's say you bought 100 shares of company xyz stock on jan. Web capital gains tax: Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. In order to figure out how to calculate this. Web this year i dashed off this quick excel to check my math on the ‘qualified dividends and capital gain tax. Hopefully it can help others.

Irs Form 1040 Qualified Dividends Capital Gains Worksheet Form Resume

These rates are lower than ordinary income tax. Web i created this excel sheet to help me with my taxation course. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the. Web capital gains tax: Foreign earned income tax worksheet.

Irs Form 1040 Qualified Dividends Capital Gains Worksheet Form Resume

Web capital gains tax: Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the. Web i created this excel sheet to help me with my taxation course. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16.

Qualified Dividends And Capital Gain Tax Worksheet 2017 —

Web this year i dashed off this quick excel to check my math on the ‘qualified dividends and capital gain tax. Prior to completing this file, make sure you fill out. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or..

Qualified Dividends and Capital Gain Tax Worksheet

Qualified dividends and capital gain tax worksheet. Web this year i dashed off this quick excel to check my math on the ‘qualified dividends and capital gain tax. Prior to completing this file, make sure you fill out. Go to www.irs.gov/scheduled for instructions. Some of the worksheets displayed.

qualified dividends and capital gain tax worksheet 2019 Fill Online

Simple capital gains worksheet let's say you bought 100 shares of company xyz stock on jan. Web taxes are taken out on both capital gains and dividend income but it’s not the same as income tax. Alan wong, cpa gains& losses sec. Go to www.irs.gov/scheduled for instructions. These rates are lower than ordinary income tax.

Qualified Dividends And Capital Gains Worksheet 2018 —

In order to figure out how to calculate this. These rates are lower than ordinary income tax. Prior to completing this file, make sure you fill out. Go to www.irs.gov/scheduled for instructions. Web schedule d tax worksheet.

Qualified Dividends And Capital Gains Worksheet 2018 —

Hopefully it can help others. Web i created this excel sheet to help me with my taxation course. Prior to completing this file, make sure you fill out. Qualified dividends and capital gain tax worksheet. Web qualified dividend and capital gains tax worksheet?

Irs Qualified Dividends And Capital Gain Tax Worksheet 2019

Simple capital gains worksheet let's say you bought 100 shares of company xyz stock on jan. Some of the worksheets displayed. Go to www.irs.gov/scheduled for instructions. Alan wong, cpa gains& losses sec. Gain or loss from sales of stocks or bonds :

Qualified Dividends And Capital Gains Worksheet Calculator —

Simple capital gains worksheet let's say you bought 100 shares of company xyz stock on jan. Some of the worksheets displayed. Data validation between investment & dividend data worksheets. Prior to completing this file, make sure you fill out. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the.

Qualified Dividends And Capital Gain Tax Worksheet 2019 worksheet today

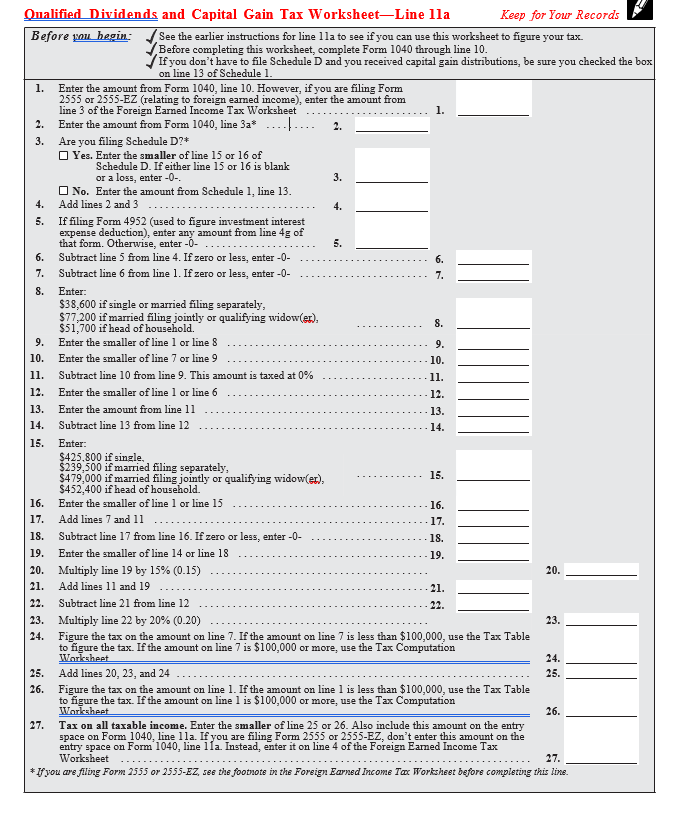

Go to www.irs.gov/scheduled for instructions. Making a unique identifier for each investment. Hopefully it can help others. Web qualified dividends and capital gain tax worksheet—line 11a keep for your records see the. Web qualified dividend and capital gains tax worksheet?

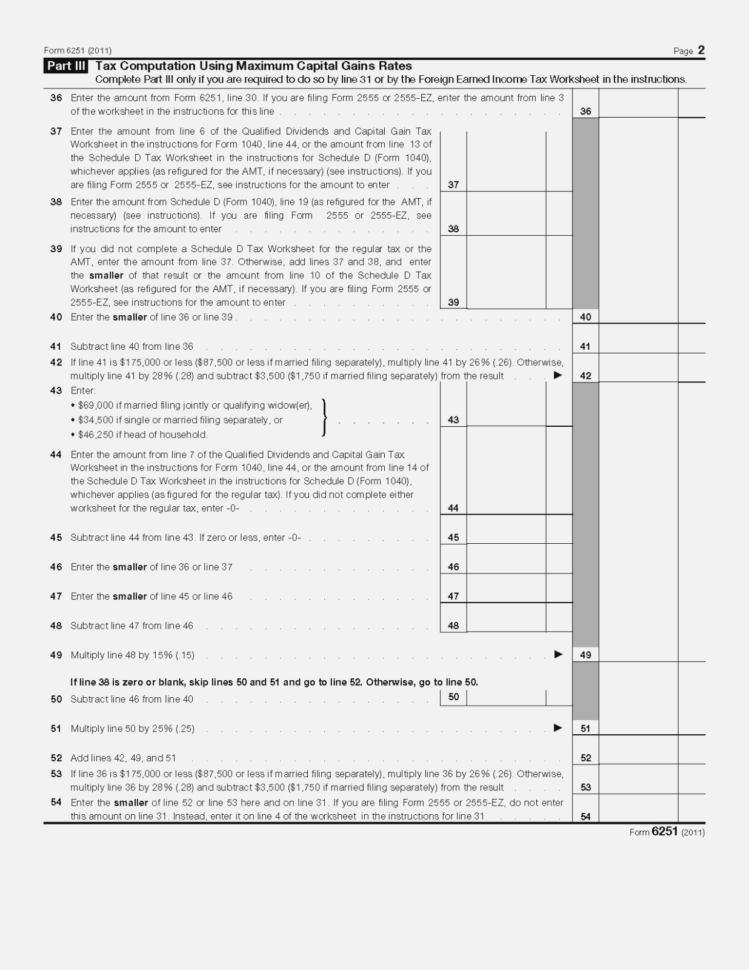

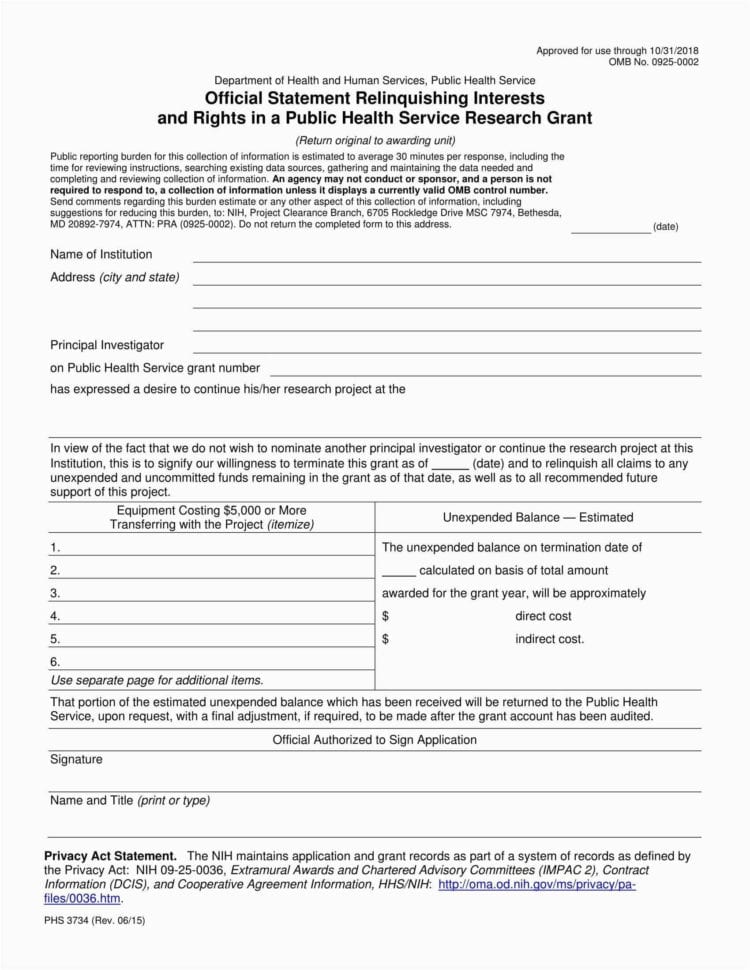

These rates are lower than ordinary income tax. Some of the worksheets displayed. Web qualified dividend and capital gains tax worksheet? Web this year i dashed off this quick excel to check my math on the ‘qualified dividends and capital gain tax. Simple capital gains worksheet let's say you bought 100 shares of company xyz stock on jan. Gain or loss from sales of stocks or bonds : In order to figure out how to calculate this. Web qualified dividends are taxed at the same rates as the capital gains tax rate; Making a unique identifier for each investment. Hopefully it can help others. Web i created this excel sheet to help me with my taxation course. Web the worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions. Alan wong, cpa gains& losses sec. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the. Prior to completing this file, make sure you fill out. Data validation between investment & dividend data worksheets. Go to www.irs.gov/scheduled for instructions. Web how to download qualified dividends and capital gain tax worksheet? Web schedule d tax worksheet. Foreign earned income tax worksheet.

Web Qualified Dividends And Capital Gain Tax Worksheet—Line 11A Keep For Your Records See The.

These rates are lower than ordinary income tax. Foreign earned income tax worksheet. Web this year i dashed off this quick excel to check my math on the ‘qualified dividends and capital gain tax. Web the worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions.

Web How To Download Qualified Dividends And Capital Gain Tax Worksheet?

Simple capital gains worksheet let's say you bought 100 shares of company xyz stock on jan. Web i created this excel sheet to help me with my taxation course. Web qualified dividends are taxed at the same rates as the capital gains tax rate; Web qualified dividend and capital gains tax worksheet?

Prior To Completing This File, Make Sure You Fill Out.

Gain or loss from sales of stocks or bonds : Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. Data validation between investment & dividend data worksheets. How to make a dividend tracking spreadsheet template in excel & google sheets.

Some Of The Worksheets Displayed.

Web schedule d tax worksheet. Making a unique identifier for each investment. Web taxes are taken out on both capital gains and dividend income but it’s not the same as income tax. Go to www.irs.gov/scheduled for instructions.